RECENT COMMENTS

Eric S. Huffstutler on What is up with the Church Hill Post Office?

lanny on then it happens to you...

JessOfRVA on then it happens to you...

Becky Metzler on Updated! Guess what's happening on Mosby/Venable?

Mary on then it happens to you...

Sid on then it happens to you...

Becky Metzler on Church Hill Startup Tackles Insurance for Freelancers

Track the local impact of stimulus money

07/22/2009 6:20 AM by John M

The most recent message from Mayor Jones includes a nifty link to the City of Richmond Stimulus Tracker, “a citizen’s guide to federal stimulus funding allocated to the City of Richmond, […] a research tool and a method of providing transparency in government.” Two neighborhood projects are detailed, the Beckstoffer’s mixed use, mixed income in-fill housing development and the Peripheral In-Line Equalization at Oakwood Project.

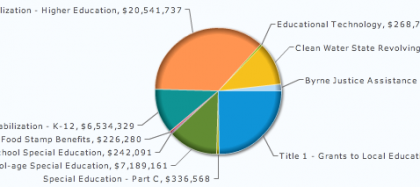

The Federal site provides a link to the Virginia site which says that Richmond has been awarded $56,524,023, not all of which has been allocated. The city site says that they’ve been specced for $17,023,709, with the bulk being directed to infrastructure upgrades.

No where on that chart do I see a category for digging a hole, throwing the money in, and covering it back up. Either the city has gotten more fiscally responsible, or this is an incomplete accounting.

I was looking for that piece in the pie chart myself. I see it “spent” all over town, but I don’t see an accounting for it.

Do you think our taxes will go down with all the new money flowing in? Wait a minute….that IS your/my money flowing in.

John, I can’t find the image you have posted above on Mayor Jones’ site. Is it just an example? When I clicked on the above links I couldn’t find education on the City of Richmond Stimulus Trackers.

The graphic above is from VA’s info for Richmond.

I think Church Hill might be on the verge of a conservative revolution! At the neighborhood picnic last night, I had conversations with people who actually admitted going to those Tea Party things to protest the continued fiscal irresponsibility of this Administration. I hope this is the beginning of a trend. Any thoughts?

One of the shortcomings of the ‘Tea Parties’ is that they do not seem to recognize the fiscal irresponsibiliy of previous administrations, only this one. I would also say that its not just administrations that have been irresponsible but everyone, especially the corporations that have feasted off the corporate welfare and citizens who have treated their flipped houses as cash ATMs.

And lastly, I would say that if we are going to consider local waste, then we might consider the muck that is already standing around Richmond’s ankles (see saverichmond.com). Remember when the City of the Future was more about fixing up public school buildings than building opera houses for the rich?

I was not really for the stimulus, but since it is here, I hope Richmond can use it for longterm projects that will create opportunities and benefit ALL citizens, especially our future ones.

Plans are in the works to renovate/rebuild schools, but it is difficult to find out much about what is going on. I only know what I do from working at a school & have been unable to track down much detail. From what I have been told, MLK MS is slated for either renovation or a rebuild (depending on final costs) in the next 18 months or so. Friends at a local architecture firm that has the contract confirm what RPS is saying.

THat was very well said, Scott.

Per #7. I think we are beginning to see that with Mayor Jones, the emperor has no clothes. The administration appears to be foundering, with no initiatives. It took eight months to staff up, with administrators whose experience is spending tax dollars for developments that aid a 23% portion of the population.With Wilder, we had corrupution, with Jones ineptness, I fear. This could be wrong. We could see a roll-out of initiatives, ranging from affordable housing initiatives that help the city;s owrkforce, not it’s chronic unemployed force, to a plan for Shockoe Bottom that does not relie on mythic public dollars for development.

Scott- Bush isn’t President anymore.

It’s BO’s job now. When he ran for President, he accepted the challenges. He ran on a platform of not increasing taxes. That’s gone well, hasn’t it? He has done an excellent job of adding a trillion dollars of debt to our country. Gotta love a stimulus bill when no one knows whats in it.

I was on Bush’s butt for his fiscal irresponsibility as well. (And Warner, Webb, Kaine and our “wonderful” Bobby Scott to name a few.)

I went to the Tea Party in Richmond. It was a blast. We need to throw them all out of office and a legitimate third party.

As far as I’m concerned, political gridlock is good. They can’t steal from you as much.

For years the Fed’s, State and Local governments have spent money like drunken sailors. Now the tab is due, the expect us to pay for their spending party.

What taxes have increased? Mine sure haven’t. I think I would have read about that.

Do tell, teabaggers, I’m intrigued. Gas tax? Sales tax? Income tax? What’s gone up?

Jeez Omelette……

I’m guessing you rent, don’t own property, don’t make enough to pay income taxes and don’t understand how corporations simply pass taxes onto the consumer, don’t know about import taxes. never looked at your withholding and haven’t a clue.

Teabag away………..but read this….don’t think you pay them?

You sound bitter. Granted, if you make less than $15k you don’t pay much in income taxes. We got your back, bud.

Accounts Receivable Tax

Building Permit Tax

Capital Gains Tax

CDL license Tax

Cigarette Tax

Corporate Income Tax

Court Fines (indirect taxes)

Deficit spending

Dog License Tax

Federal Income Tax

Federal Unemployment Tax (FUTA)

Fishing License Tax

Food License Tax

Food Sales Tax

Fuel permit tax

Gasoline Tax

Hunting License Tax

Inflation (a tax on everything)

Inheritance Tax Interest expense (tax on the money)

Inventory tax IRS Interest Charges (tax on top of tax)

IRS Penalties (tax on top of tax)

Liquor Tax

Local Income Tax

Luxury Taxes

Marriage License Tax

Medicare Tax

Property Tax

Real Estate Tax

Septic Permit Tax

Service Charge Taxes

Social Security Tax

Road Usage Taxes (Truckers)

Sales Taxes

Recreational Vehicle Tax

Road Toll Booth Taxes

School Tax

State Income Tax

State Unemployment Tax (SUTA)

Telephone federal excise tax

Telephone federal universal service fee tax

Telephone federal, state and local surcharge taxes

Telephone minimum usage surcharge tax

Telephone recurring and non-recurring charges tax

Telephone state and local tax

Telephone usage charge tax

Wireless tax (XM, Cell Phone, Satellite)

Telephone Pole tax (paid on your wired bill)

Toll Bridge Taxes

Toll Tunnel Taxes

Toll Road Tax

Traffic Fines (indirect taxation)

Trailer Registration Tax

Utility Taxes (Gas, Water, Sewer, Electric)

Vehicle License Registration Tax

Vehicle Sales Tax

Watercraft Registration Tax

Well Permit Tax

Workers Compensation Tax

In Richmond:

Recycling “Fee”

Trash collection “Fee”

Storm water runoff “Fee”

Meals Tax to pay for the new performing art center.

Hotel tax

These are especially onerous as they are technically not deductible on your taxes and have to be paid with after tax dollars.

Special District Tax assessments “Fee” Landowners in the bottom and slip pay an extra fee for the guys in yellow shirts.

Trickle Up Poverty.

Oil industry profits are less than the taxes they pay

On average 45% of what you make….still claim you don’t pay much? Do you eat food? I thought so. Care to pick which ones of the above are built into your food price?

Care to rebut?

Oh, I forgot….the new health-care tax if it passes. Pay taxes if your policy is too good, pay taxes if your are an employer and pay taxes if you have no insurance.

“We’re from the government and we are here to help you”.

Ever fly? Look at your bill….here’s a few more.

U.S. Domestic Segment Tax – $3.60 per flight segment, per passenger. A segment is defined as one takeoff and landing.

U.S. Security – September 11th Security Fee – $2.50 per flight segment. A segment is defined as one takeoff and landing.

Passenger Facility Charges (PFCs) – Local airports assess Passenger Facility Charges of $3 to $18 per passenger. This amount varies by airport.

Alaska/Hawaii – $8 per flight segment, per passenger on certain segments beginning or ending in Alaska or Hawaii.

International travel

The U.S. and foreign governments charge additional taxes and fees for international travel. International fares do not include government-imposed taxes/fees of up to $107. Taxes and fees are subject to change at the discretion of each country’s government and may be adjusted for inflation.

You’re welcome.

To forestall any more right-wing cut&paste spam, please note that the question posed wasn’t “which taxes do we pay”, but “what taxes have increased?”

I started this this site almost 5 years ago partly as escape from the pointless back and forth of much of takes place on the national political arena. When we focus locally, political party stuff and ideological posturing tend to fall by the wayside. I can see how this post leads to a back&forth that connects to more broad politics, but dang, just copying shit from Craigslist or wherever isn’t really contributing much to any kind of real discussion.

So, seriously, which taxes have gone up recently? I don’t make much and my house ain’t much, but I haven’t seen anything except that new storm water fee. Is all of this posturing just a preemptive move against any possible new taxes? Kind of like the ammunition hording?

I work for the Community College system and I have seen the impact of the stimulus money. They would of had to layoff hundreds of faculty/staff this spring at a time when people are swarming back to school. More faculty means more classes, means higher trained workforce. It is exactly what Virginia needs right now.

Where is the help for small business owners? The ARC loans through the SBA are a shell game at best. Mom and pops aren’t looking for a freebie, but I know many who could use some relief in the form of low to no-interest loans to help pay off high interest lines of credit and credit card debt to get them through this slump. Unfortunately, many aren’t and won’t make it.

#12. I think your calculations are correct, and…I don’t mind. I think we generally get what we pay for. Our health system is currently more expensive and less efficient than most of the western world, but I live in a neighborhood where we don’t have to lock the doors at night…good policing, paid for with tax dollars. More and more families are returning to public schools, paid for with tax dollars. The food I buy at Ukrops is safe because of the inspections paid for with tax dollars. My dogs are safe from rabies because of the public eradication programs, and we love the publicly funded parks.

In short, I think the money is generally well-spent.

John,

I fail to see how a discussion of a tax issue is a “right wing” issue unless you are willing to stipulate that all tax increases must be a “left wing” activity.

I noted that Bush was also responsible.

Maybe that makes me a Libertarian?

From the above, it would be a shorter to say which ones have not increased over the last five years.

Call it what you will, it was the linking out to cut&paste teabag talking points that gave me that take on your stance. You can also note that Bush was also responsible, but none of these folks so suddenly spazzy about taxes were out in the streets like this until Obama got elected.

And I’ll ask again, in case I’m missing something: which taxes have gone up? Can you point to a specific tax increase? The tax on cigarettes went up last year, right? Hasn’t our real estate tax actually dropped from like $1.40 per $100 to $1.20 per $100 over the past 7 or 8 years?

You are quite correct, John, I haven’t heard a single teabagger point to a specific tax increase. If I’m wrong, show me the vote, but you’re not going to find any.

There’s been some talk about possibly raising taxes on millionaires, sure, but I doubt that would impact any of the angry white people yelling about the president’s birth certificate.

I’m sure you’re a nice guy, PCP, but you guys seem to have confused actual tyranny with the consequences of losing an election. Believe me, I know. It sucks.

John, and Omelette, thanks for the new term, teabaggers, I like it!!!!!!!!!!!!!!

Don’t lump the tea party folks with the right wingers. Some of us wouldn’t mind taxes going up if some programs were cut and we got the deficit in line. It’s not a right wing thing b/c all this crap went on under Bush too.

@Sundagger- I would argue our system is less efficient due to all of the regulation. States implement different regulations that each insurer must abide by, etc. I’d also argue that it isn’t the most expensive, we just pay more. The difference being that we are paying for more services.

Are we talking about the Tea Party folks or teabaggers? Big diff, or not? I think most Tea Party enthusiasts would not want to be referred to teabaggers in the alt slang context.