RECENT COMMENTS

Joel Cabot on Power Outage on the Hill

Eric S. Huffstutler on What is up with the Church Hill Post Office?

Eric S. Huffstutler on What is up with the Church Hill Post Office?

Yvette Cannon on What is up with the Church Hill Post Office?

crd on Power Outage on the Hill

Assessments up across the area

06/18/2013 8:39 PM by John M

The 2014 reassessments are in the mail and online and a spot check around the neighborhood shows an increase for each of the 10 properties sampled (a big change from 3 years ago). How’s yours?

Received my 2014 tax assessment for my property in Church Hill North. My property’s value increased by almost 8% according to the letter. […]

Have you heard from anyone else that their taxes were up? Mine is +18.42%.

Ours was down about 5%

yup, way up there. 14% in one year, I wish I could make that on my savings account!

Our home value was up 20% but the land remained the same.

Mine went down 7.65%. I think it is still correcting from earlier.

guess I’ve got the record so far up 21% in Church Hill compared to friends up 1% in the Fan

@churchillian I assumed my increase was due to renovations and improvements. Have you done a lot of work on your home? What area are you in?

Nothing at all! went up from $216k to $256. Neighbor one block over said that his went down! Just doesn’t make sense.

Churchhillian – send Chuck Jones (one of the City Assessors) an email with your property address and question the increase. He’s a very nice guy and will look into it for you and give you the reasoning behind the increase if it’s accurate or guild you through appealing/or correct the error.

Charles.Jones@richmondgov.com

39.87% increase! We nearly had heart failure. Calling the City was useless….a real exercise in futility. 🙁

Jim – We had real luck challenging our assessment six years ago and it went down. From what I heard when we were buying, the city rarely turns down an appeal.

All this said – these numbers are discouraging. The city is raising some and lowering others and there doesn’t seem to be any rhyme or reason if literal neighbors had different outcomes.

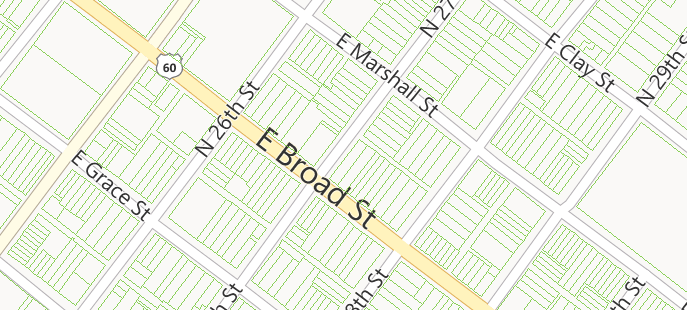

For the record, we are north of broad, technically Union HIll and ours went down. Would love to hear where others are and how their assessment was affected.

Mine was the +18.42 mentioned in the original post. We’re slightly north of Broad on 32nd. No major improvements in 8 years. Thanks to #10, I’ll email Chuck Jones.

Here’s how my taxes went…incredible!!!

203 North 36th – increased145%

3308 East Broad – increased113%

3308 East Broad 3 bay garage – increased120%

Others stayed the same but did not go down.

I will definitely appeal.

Mine stayed the same, strangely. Mason, if I were you, I would most definitely appeal those. Too much of an increase in one year, among other things. I appealed five years ago and won.

72% increase in our assessment. Gonna appeal.

60k over appraisal done this week

Anyone have any idea if City Counsel is orchestrating some pressure on the assessor’s office to increase revenue beyond reasonable margins.

Or why there is so much disparity from one address to the next?

What about Citywide?

Are assessments going up in Jackson Ward or the Fan?

Mixed and maybe trending down in Northside

http://northrichmondnews.com/2013/06/18/2014-reassessments-mixed-across-the-area/10345

Flat with some slight increase in the Fan

http://fanofthefan.com/2013/06/2014-assessments-show-slight-increases/

I went on-line to see the assessments of neighboring properties. A house at the end of our block that was recently condemned saw the land value assessment drop from $39K to $30K. The improvement assessment–that would be the recently condemned building–ROSE from $5K to $9K. The building itself has had no improvement, and has actually deteriorated further.

Ours was down approximately 10%.

Mason #18, I think John Murden answered your question pretty clearly in the next post as to other neighborhoods.

Legally, council is not supposed to put pressure on any city agency or even give orders to any city employee (I know, that doesn’t mean it doesn’t happen). There was some issue with Reva Trammel some years ago when it appeared she was giving orders to someone in the police dept. and as I recall (memory isn’t perfect) that’s when it was made clear that council was not supposed to exert influence….

Seriously though, put in an appeal. Your percentages don’t make sense. The guy I talked to five years ago when I appealed was very rational and helpful; Michael …. I can’t think of his last name but it’s Italian and his sister is Lisa, he knew Church Hill from past HOTHs. Not sure why I ended up with him as the person who ruled on my appeal but it went my way. It’s not a complicated process, go for it and good luck.

@14… It looks like its time to pay up for all of the years 203 was under-assessed. I bet you weren’t complaining then. This year’s assessment on your property appears very reasonable. Good luck with the appeal but comps in the area support your assessment.

Mason,

I’m inclined to agree with Laura on this one. I doubt you’d be willing to sell those properties for what they were previously assessed at (if you are, drop me a line 😉 ) so it’s only fair that your assessment matches fair market.

Your math is also incorrect. An “increase of 100%” would mean that the assessment doubled. That doesn’t appear to be the case.

@22. Real estate assessments should be completed at 100% Fair Market Value. The assessor’s office has been doing a great deal of catch-up over the last few years and they’re getting closer and closer to nailing it each year. Last year, 203 N 36th St was assessed at $171k with an improved value of $76k. This is a two story brick, single family home that faces the park; 4 beds/2.5 baths and 1916 sq ft. in good condition. Are you kidding me? It looks like someone’s been receiving a GIFT from the assessor’s office for many years. The new assessment came back at $281k…closer to the real market value…it may be a bit higher considering its location. He can challenge away but this one will get a flat denial. There are far too many comps that would support the value of this property. Not everyone wins assessment appeals…the numbers are the numbers.