RECENT COMMENTS

Eric S. Huffstutler on What is up with the Church Hill Post Office?

Eric S. Huffstutler on What is up with the Church Hill Post Office?

Yvette Cannon on What is up with the Church Hill Post Office?

crd on Power Outage on the Hill

Foreclosures in Richmond (2005-2011)

12/20/2011 8:18 AM by John M

Found on the city’s site:

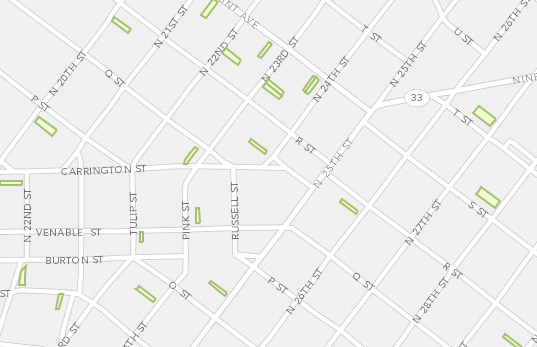

A map of foreclosed parcels in Richmond, VA. Web Map by ASR_Richmond (last modified: November 22, 2011)

One thing that may not be clear is that you can turn on different years’ data by clicking details>show contents of map and the various layers are able to be turned on or off.

At the end of 2011, inventory of unsold homes in the Richmond Va area started to drop including foreclosures. Hopefully that trend will continue so a recovery in housing can take hold.

Why is a “recovery” in the housing market even a good thing? It means housing becomes more expensive for folks. I honestly hope prices stay low and we don’t waste trillions more building another bubble, while simultaneously making housing unaffordable for many. Keep the prices falling and hope that we reach a sustainable flat level so affordable housing can be had for all. The only people this hurts is suckers who pay too much, realtors who live off of flippers and builders who rape virgin land to create more sprawling communities.

Alex, you left off appraisers and realtors who encourage higher prices from the end of your post LOL!

Good catch, yeah I guess I overlooked the appraisers and the whole financing side. None of this would be so bad if the bubbles weren’t being financed with our money and we could just let the suckers burn themselves out. Instead the realtor and developer lobbies have convinced congress that rapid growth in housing is a good thing. Home prices can’t rise faster than wage growth for an indefinite period of time. Wage growth is flat. The biggest liquidity issue in the housing market right now is not a glut of foreclosures but rather too many homes where the seller wants what they paid in the bubble for it. Once that fixes, we should be able to start seeing homes sell again. Hopefully this time folks learn not to trust the realtors who tell them that homes should appreciate 20% annually indefinitely and will only buy homes they can afford to live in for a long time even if it never gains in value.