RECENT COMMENTS

Maggie Walker Community Land Trust setting up shop on 25th Street

The Maggie Walker Community Land Trust (MWCLT) is coming to 25th Street — they will be sharing the upstairs space at the green Markel building at 1111 North 25th Street with the staff of Urban Hope.

Unfamiliar with the MWCLT? They are a nonprofit organization formed in 2016 whose goal is to maintain permanently affordable homeownership opportunities for low and moderate-income households. They offer an alternative route to home ownership that both helps ensure the economic diversity of our community and fosters homeownership.

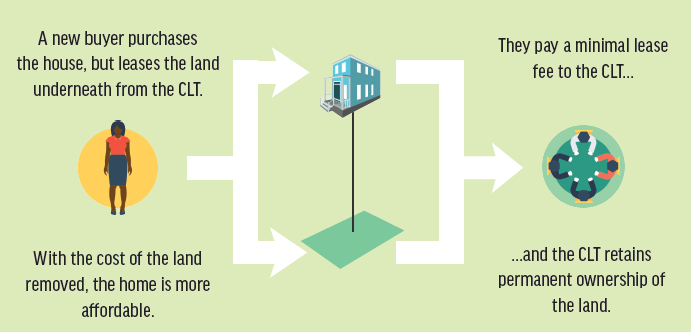

Using a community land trust (CLT) model, MWCLT owns and stewards land to ensure long-term affordable homeownership. A homebuyer purchases the house, but leases the land from the CLT for a nominal fee.

Because the cost of the land is removed from the purchase price, the house is more affordable, resulting in a smaller down payment and lower monthly payments. By removing the cost of the land from the purchase price, the community land trust model lowers the barrier to homeownership and keeps homes affordable for future generations.

When the homeowner sells, the family earns a portion of the increased property value, with the remainder staying in the home, preserving the affordability for future low- to moderate-income families.

The CLT model neatly solves a problem of the model of affordable housing where the initial cost is subsidized, but where the cost of the house jumps to market price when the first buyer resells the property.

Who holds the mortgage?

I believe the home buyer holds a regular mortgage secured just by the home itself, while “leasing” the land from the CLT.

This would seem to dramatically distort the incentive or ability of the homeowner to move wouldn’t it? They can’t fully realize the appreciation of the asset which diminishes their ability to trade? This would also seem to distort comps and cause tax problems if the price of this basket of homes is kept artificially low? Interesting idea, but i don’t really see a long term or even midterm upside for the homeowner or neighborhood.

Maybe they can find homes for the 15-20 people that seem to gather around there almost every day 🙂

This is a great plan, but I just don’t think it’s right for the greater Church Hill area.

This would be much better for someplace like Randolph or near west end.

This area is one of the most affordable places to live. I wouldn’t be surprised if Church Hill has more affordable units per capita than any area in the entire United States.

The ratio of affordable housing units to market price units in this area is already ridiculously high.

If our ratio wasn’t so ridiculously high, this would be a great plan.

Also, who would be paying the property tax?

There are some great questions here! I’m the Community Coordinator for MWCLT, and I’m happy to answer any of your questions. Here are a couple of clarification points:

1) James Smith is correct–the mortgage for a CLT home is just like any other home mortgage. However the land price is removed, and the land is leased from the trust for a nominal fee.

2) Generally, local assessors exclude CLT transactions when appraising other “fee-simple” homes nearby, because they are not regarded as traditional market sales.

3) Property taxes will be paid by the homeowner.

If you have any other questions or concerns, please don’t hesitate to contact me (nikki@mwclt.org)!

Nicki thanks for breaking it down.

Does the open market determine the resale value or do you guys have a cap that the seller can sell the home for?

Doesn’t Baltimore use land leases? Has it increased private ownership in the ghettos or added more slum lords?

Dave Seibert:

MWCLT has a resale formula that is based on the market value. The CLT home is appraised at the time of sale and resale. At the time of resale, the CLT homeowner receives 50% of the appreciation–the difference between the appraised value when they purchased the home and the appraised value at the time of sale (in addition to all of the equity from the downpayment and monthly mortgage payments).

The new sales price is then equal to the initial purchase price, plus 50% of appreciation, plus transaction fees.

I just posted an infographic on our facebook page that might help illustrate. (Part of the graphic hasn’t made it onto the website, yet.) https://www.facebook.com/MWCLT/

Hope that helps!